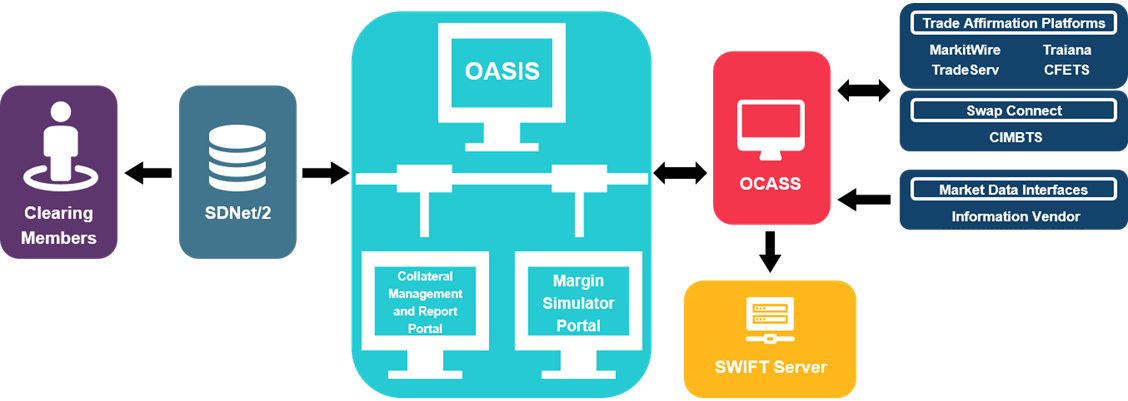

The OTC Clearing and Settlement System (OCASS) is the clearing and settlement system for the OTC derivatives products of OTC Clearing Hong Kong Limited (OTC Clear) and OTC Account Services Information System (OASIS) is a user interface web portal which is accessible to the Clearing Members for retrieval of different types of reports and submission of request for movement of collateral.

OCASS is a highly electronic and automated clearing and settlement system which is capable of supporting various types of OTC derivatives products. The reports which cover the settlement, trading activities, margin requirements and market data are produced by OCASS for further dissemination to the Clearing Members via OASIS. OCASS comprises the core derivatives clearing and settlement functionality and the margining engine. Different functions are well integrated in OCASS to have a one-stop system solution which yields a highly efficient workflow for maximum synergy. Clearing Members can access OASIS via SDNet/2 for retrieval of reports and management of collateral.

A. Benefits

The key benefits of OCASS include:

1. Consolidated Clearing and Settlement System

OCASS is an integrated clearing system for OTC derivatives market covering interest rate and foreign exchange derivatives products. It provides a common clearing application, associated user interface (OASIS) and operational procedures for all OTC derivatives products. It also provides a seamless interface for electronic trade affirmation platforms, market data and SWIFT.

2. System Flexibility

The OCASS architecture is highly flexible and can accommodate new OTC derivatives products, multiple market environment and extended market operation without major development effort. This enables OTC Clear and Clearing Members to implement market initiatives with relatively short lead-time.

3. Straight Through Processing

The OCASS is highly automated with straight through processing in place for improved operational efficiency and reduced risk.

4. Risk Management Functionality

OCASS can process clearing of transactions on both real-time basis and portfolio basis, and provides extensive access to clearing data to support the risk management functions.

B. System Overview

The following diagram shows an overview of OCASS including the interface among OCASS, OASIS and different electronic trade affirmation platforms for the flow of trades.

C. Key Features and Functionalities

(i) Key features and functionalities of OCASS include:

1. Product Design Model

The product design model allows considerable flexibility for the introduction of new

OTC derivatives products without the need for significant development effort.

2. Account Structure

OCASS provides a flexible account structure and different types of accounts can be established for each Clearing Member. In addition to the house position account, client position accounts will also be available when OTC Clear starts to offer client clearing services.

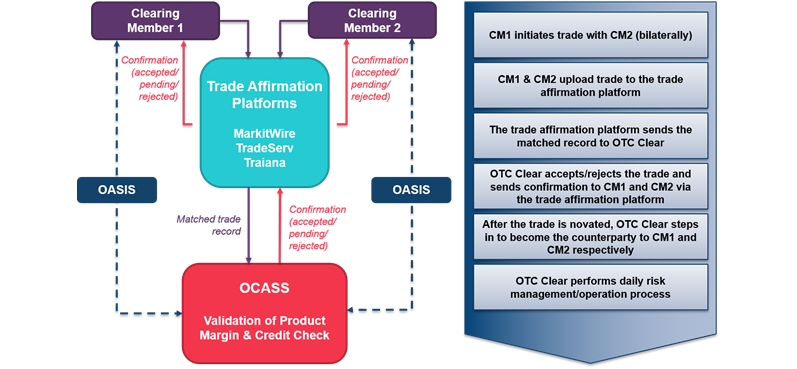

3. Real time novation

OCASS’s real time novation function allows trades submitted from trade affirmation platform to be cleared instantly during business hours (except for any period of portfolio novation cycle) provided that the margin and credit check are satisfied. When a trade is submitted to OCASS for clearing, OCASS will perform two checks:

1. Limit Check: Determine whether any pre-define limit will be breach after clearing the trade.

2. Margin Check: Determine whether excess collateral is sufficient to cover the incremental Margin required of the trade.

The trade will not be cleared if any of the above two checks cannot be satisfied.

4. Margining

During the day, OCASS’s margining system will update initial margin of each account as new trade gets cleared and variation margin of each account with reliable market data received from independent vendor. The method of calculating initial margin and variation margin is in line with international standards and industry practice.

The margin calculated for incoming trades to be cleared will be collected upfront via real-time novation process.

5. Audit Trail

OCASS maintains an audit trail of clearing transactions and users’ activities, which can be reviewed as required.

6. Reports

Clearing Members can retrieve and download clearing, settlement and risk related reports through the OASIS. Various clearing data are also available for retrieval and processing.

(ii) Key features and functionality of OASIS include:

1. Movement of Collateral

A maker-checker mechanism is in place for the Clearing Members to submit and approve the request for movement of collateral. Clearing Members can access OASIS through SDNet/2 secured internet line.

2. Retrieval of Reports

D. Overview of the Workflow for Trade Submission

*For Swap Connect, please refer to the Swap Connect webpage

E. Overview of the Information Communicated to the Clearing Members