Hong Kong Exchanges and Clearing Limited (HKEx) released today (Thursday) the findings from its Cash Market Transaction Survey 2012/13, showing year-on-year increases in the value of all types of trading in its securities market and a five percentage point increase in retail investors’ online trading to nearly 40 per cent of all their trading.

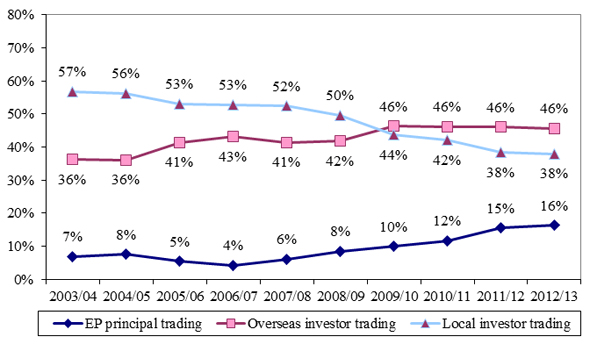

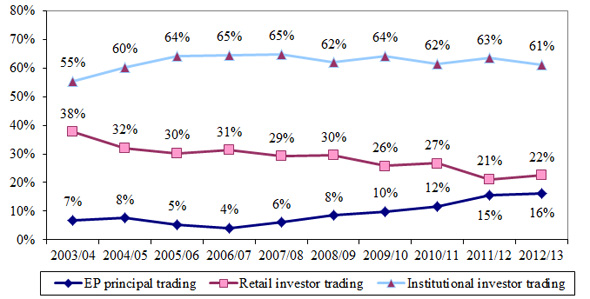

In 2012/13, trading in HKEx's securities market had a similar pattern as in 2011/12. Local investors and overseas investors contributed 38 per cent and 46 per cent respectively of total market turnover value, similar to the levels in 2011/12. Institutional investors contributed 61 per cent of total market turnover value (63 per cent in 2011/12) while the contribution from retail investors was 22 per cent (21 per cent in 2011/12). (See Figures 1 and 2.)

Key findings of the 2012/13 survey

- Overseas institutional investors, the largest contributors among all investor types, contributed 41 per cent of total market turnover, compared to 42 per cent in 2011/12 (see Figure 1).

- Local institutional investors contributed 20 per cent to total market turnover, compared to 21 per cent in 2011/12 (see Figure 1).

- Local retail investors contributed 18 per cent to total market turnover, compared to 17 per cent in 2011/12 (see Figure 1).

- Exchange Participants' principal trading contributed a record high of 16 per cent of total market turnover in 2012/13, compared to 15 per cent 2011/12 (see Figure 1).

- Findings regarding trading value by overseas investors (see Figure 3) show that:

- US investors were the largest contributors to overseas investor trading in 2012/13 with a contribution of 28 per cent, down from 32 per cent in 2011/12.

- UK investors, the second largest contributors, accounted for 26 per cent of overseas investor trading in 2012/13, compared to 25 per cent in 2011/12.

- Continental European investors were ranked third with a contribution to overseas investor trading of 14 per cent in 2012/13, up from 12 per cent in 2011/12.

- The contribution of investors from Mainland China to overseas investor trading was 11 per cent in 2012/13, up from 8 per cent in 2011/12.

- Asian investors in aggregate contributed 24 per cent of overseas investor trading in 2012/13, up from 21 per cent in 2011/12.

- There were 22 reported origins of overseas investors in Asia and over 38 reported origins of overseas investors outside Asia, Europe and the US.

- Over the past decade, trading from Mainland China investors recorded a compound annual growth rate of 27 per cent, the highest among all individual overseas origins (see Table 1).

- Retail online trading accounted for 39 per cent of total retail investor trading (up from 34 per cent in 2011/12) and 8 per cent of total market turnover (compared to 7 per cent in 2011/12) (see Figure 4).

The Cash Market Transaction Survey has been conducted annually since 1991. Each year’s survey covers Hong Kong’s securities market turnover for the 12-month period from October the previous year to September the following year. For the 2012/13 survey, questionnaires were sent to a target population of 488 Exchange Participants. The response rate was 94 per cent by number and 98 per cent by turnover value of the target respondents.

The full report on the HKEx Cash Market Transaction Survey 2012/13 is available on the HKEx website.

Notes:

| 1. |

Cash market, securities market and stock market are interchangeable and refer to shares, bonds, funds, derivative warrants and other products traded on The Stock Exchange of Hong Kong Limited, a wholly-owned subsidiary of HKEx.

|

| 2. |

Stock Exchange Participant, or EP, principal trading is trading on the EP firm' own account.

|

| 3. |

Retail online trading refers to trading originating from orders entered directly by individual/retail investors and channelled to brokers via electronic media (eg, the Internet).

|

| 4. |

The survey' target respondents were EPs. Their responses stemmed from their own understanding of their clients. HKEx had no direct access to EPs’ clients, nor could it verify their identities.

|

| 5. |

One of the limitations of the survey is that EPs might not know the true origins of all their client orders. For instance, an EP might classify transactions for a local institution as such when in fact the orders originated overseas and were placed through that local institution, or vice versa. In some cases, EPs might not be able to identify the composition of orders channelled via banks and might regard them as institutional client orders directly from the banks. As a result, the findings may deviate somewhat from the true picture.

|

Figure 1. Distribution of cash market trading value by investor type

(Oct 2012 – Sep 2013)

Note: Numbers may not add up to 100 per cent due to rounding.

Figure 2. Distribution of cash market trading value by investor type

(2003/04 – 2012/13)

(a) Local vs overseas

(b) Retail vs institutional

Note: Numbers may not add up to 100 per cent due to rounding.

Figure 3. Distribution of overseas investor trading value in cash market by origin

(Oct 2012 – Sep 2013)

| # |

In 2012/13, reported origins in "Rest of Asia" were Bangladesh, Brunei, Cambodia, India, Indonesia, Kazakhstan, Laos, Macau, Malaysia, Maldives, Mongolia, Myanmar, Pakistan, Philippines, South Korea, Sri Lanka, Thailand and Vietnam.

|

| * |

In 2012/13, reported origins in "Others" included Algeria, Anguilla, Bahamas, Bahrain, Belize, Bermuda, Brazil, British Virgin Islands, Canada, Cayman Islands, Chile, Côte d’Ivoire, Curacao, Cyprus, Ecuador, Grenada, Isle of Man, Israel, Jersey, Kuwait, Liberia, Mauritius, Mexico, New Caledonia, New Zealand, Oman, Panama, Peru, Qatar, Russia, Samoa, Saudi Arabia, Seychelles, South Africa, St. Kitts & Nevis, Turkey, United Arab Emirates and Venezuela. |

Table 1. Compound annual growth rate (CAGR) in trading value

by investor type in the past decade