Hong Kong Exchanges and Clearing Limited (HKEx)’s Derivatives Market Transaction Survey 2006/07 (covering the period from July 2006 to June 2007) found that Exchange Participants (EP) have become the biggest contributor to its derivatives (futures and options) market, driven by the increasing dominance of the stock options segment. The contributions from both local and overseas investors remain significant.

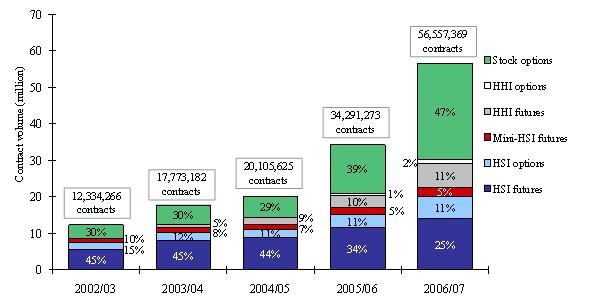

In 2006/07, derivatives market turnover increased by 65 per cent to 56.6 million contracts from 2005/06. Of this, 47 per cent was trading in stock options, up from 39 per cent in 2005/06. By contract volume, stock options grew by 97 per cent from 13.4 million contracts in 2005/06 to 26.3 million contracts in 2006/07. (Figure 1)

Some key findings of the 2006/07 survey

-

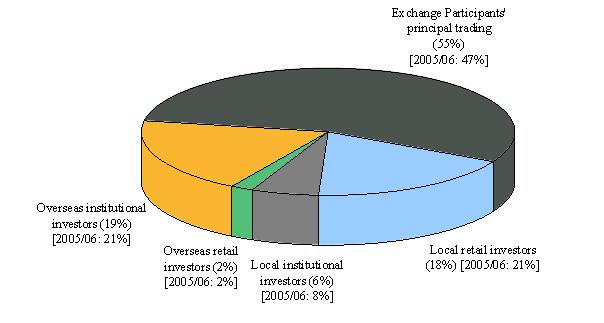

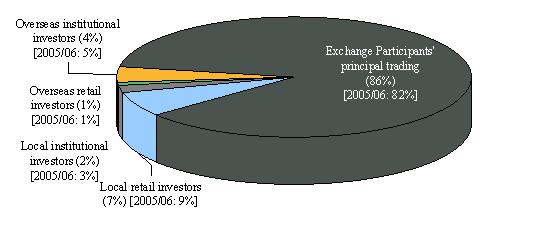

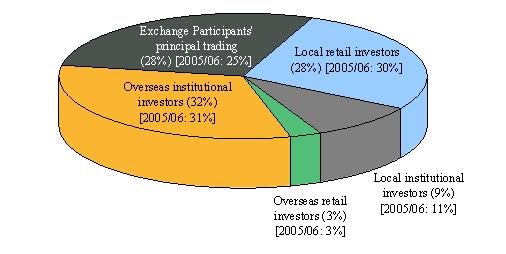

EP principal trading (comprising market maker trading and EP proprietary trading) contributed 55 per cent to total market turnover (47 per cent in 2005/06), 86 per cent to stock options turnover and 28 per cent to turnover in other derivatives. (Figure 3)

-

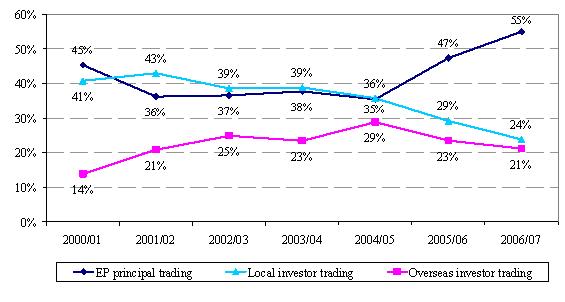

By geographical origin (excluding the 55 per cent contributed by EPs), local investors contributed 24 per cent to total market turnover (29 per cent in 2005/06), and overseas investors contributed 21 per cent (23 per cent in 2005/06). (Figure 2)

-

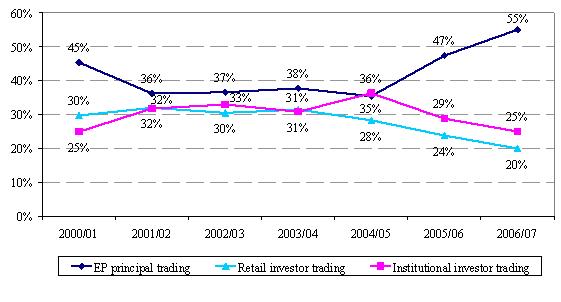

By investor type (excluding the 55 per cent contributed by EPs), retail investors contributed 20 per cent to total market turnover (18 per cent from local investors, 2 per cent from overseas investors) and institutional investors contributed 25 per cent to total market turnover (6 per cent from local investors, 19 per cent from overseas investors). (Figures 2 and 3)

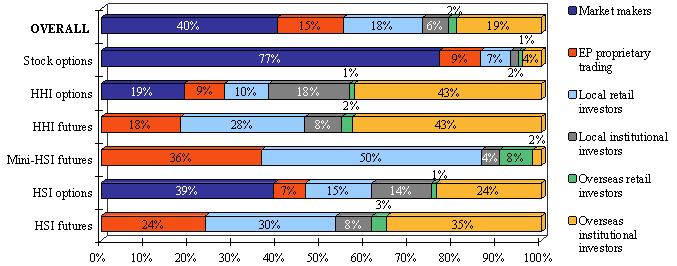

- By product: (Figure 4)

- For Hang Seng Index (HSI) futures, overseas institutional and local retail investors were the dominant contributors (35 per cent and 30 per cent respectively of the product volume).

- For Mini-HSI futures, the dominant contributors were local retail investors (50 per cent).

- For H-shares Index (HHI) futures and HHI options, overseas institutional investors were the major contributors (43 per cent for both).

- For stock options and HSI options, EP principal trading was dominant (86 per cent and over 46 per cent respectively).

-

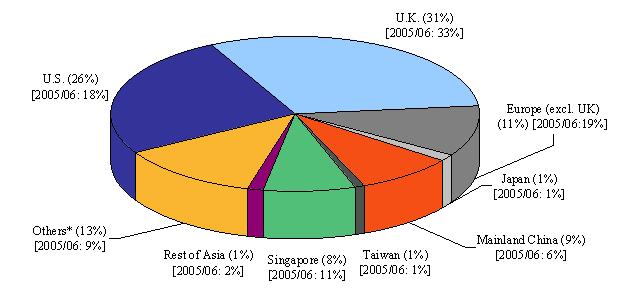

UK investors contributed the most to overseas investor trading in 2006/07 (31 per cent, compared to 33 per cent in 2005/06). US investors came second (26 per cent, compared to 18 per cent in 2005/06). (Figure 5)

-

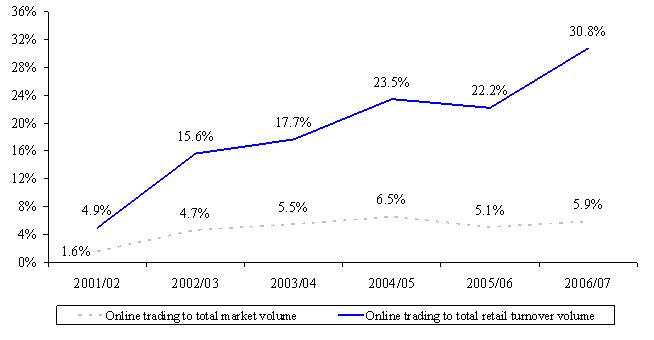

Retail online trading contributed 31 per cent of total retail investor trading (22 per cent in 2005/06) and 6 per cent to total market turnover (5 per cent in 2005/06). (Figure 6)

The Derivatives Market Transaction Survey has been conducted annually along similar lines since 1994. This year’s survey covered HSI futures, HSI options, Mini-HSI futures, HHI futures, HHI options and stock options, which together accounted for about 99.3 per cent of the total turnover of the HKEx derivatives market during the study period. The survey had an overall response rate of 92 per cent and the respondents contributed 96 per cent of the total turnover during the study period.

The full report on the HKEx Derivatives Market Transaction Survey 2006/07 is available on the HKEx website.

Notes :

|

3.

|

One of the limitations of the survey is that Exchange Participants might not know the true origins of all their client orders. For instance, an Exchange Participant might classify transactions for a local institution as such when in fact the orders originated from overseas and were placed through that local institution, or vice versa. As a result, the findings may deviate somewhat from the true picture.

|

Figure 1. Contract volume and percentage of total by product under study

(2002/03 – 2006/07)

Note: Numbers may not add up to 100% due to rounding.

Figure 2. Distribution of derivatives market trading volume by investor type

(2000/01 – 2006/07)

(a) Local vs overseas

(b) Retail vs institutional

Note: Numbers may not add up to 100% due to rounding.

Figure 3. Distribution of derivatives market trading volume by investor type

(Jul 2006 – Jun 2007)

(a) Overall

(b) Stock options

(c) Futures & options (excl. stock options)

|

(2)

|

Numbers may not add up to 100 per cent due to rounding.

|

Figure 4. Distribution of derivatives market trading volume by investor type

for overall market and each product (Jul 2006 – Jun 2007)

|

(2)

|

Numbers may not add up to 100 per cent due to rounding.

|

Figure 5. Distribution of overseas investor trading volume in derivatives by origin

(Jul 2006 – Jun 2007)

Figure 6. Retail online trading to total retail turnover volume

and to total derivatives market volume (2001/02 – 2006/07)