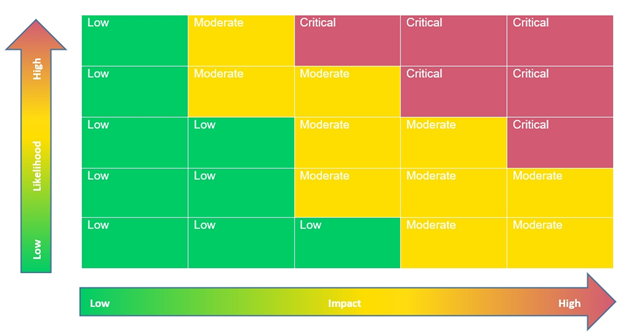

The issuer may make use of a “risk heat map”, as illustrated in the diagram below, to assess the impact of the identified risks that are recorded on its risk register. In the “risk heat map”, the issuer’s top risks (which may include existing and potential risks) should be plotted into a matrix and graded in accordance with their likelihood of occurrence and impact on the issuer’s objectives and goals. The board can consider the resulting “heat” rating and review / adjust the risk management and internal control systems to mitigate such risks.